Artificial intelligence (AI) is quickly becoming one of the most transformative technologies of our time. For investors, this presents both opportunities and risks. The challenge lies in identifying the right AI stocks to invest in and avoiding those destined to flop. In this article, I’ll share insights on how to find the best AI stocks, avoid pitfalls, and make smart AI investments.

Remember 1996: A Lesson for Today’s AI Craze

If you were around in 1996, you might recall the early days of the internet. I remember the excitement of connecting to the internet through services like AOL and CompuServe, discussing stocks on bulletin boards, and watching the tech world evolve. Back then, no one could have predicted how deeply the internet would integrate into every part of our lives. Fast forward to today, and we’re witnessing a similar evolution with AI. Just like the internet revolutionized commerce, communication, and finance, AI is poised to do the same—but on an even larger scale. Figuring out how to invest in AI now feels a lot like investing in the internet back in the ’90s.

The Explosion of AI Companies

Today, there are nearly 17,000 AI companies in the U.S. alone, with thousands more around the globe. With so many companies flooding the market, how do you identify the best AI stocks to invest in?

History tells us that only a few companies will stand the test of time, just as Amazon and eBay survived the dot-com crash while countless others failed.

How to Find Undervalued AI Stocks and Avoid Hype

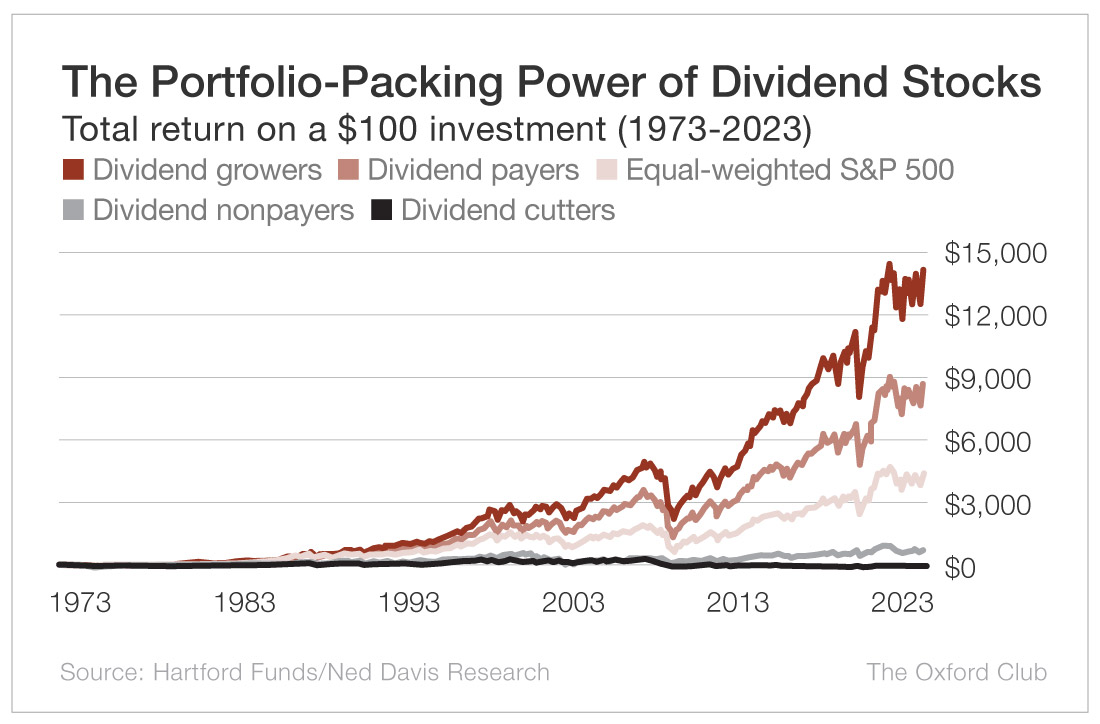

The key to successful AI investing lies in knowing which companies have substance and which are simply riding the AI wave. A crucial trick is to focus on AI dividend-paying stocks.

Why?

Companies that consistently pay dividends are often more stable, financially sound, and poised for long-term growth. This strategy not only helps you avoid risky, overhyped stocks but also positions you to benefit from the upside of AI while enjoying steady returns. Finding the best AI stocks starts with looking at companies that reward their shareholders through consistent and rising dividends.

Dividends: Your Best Defense in an AI Frenzy

Investors often get caught up in the allure of small-cap stocks that promise to be the next big thing. But the truth is, many of these companies are more likely to fizzle out like Pets.com than to become the next Microsoft or IBM. How to find undervalued AI stocks that offer real value requires looking beyond the hype and focusing on companies that have proven they can generate profits and reward shareholders. In fact, dividend-paying AI companies offer a double benefit: stability and potential for significant growth as AI technology continues to advance.

Proven AI Giants to Watch

While many investors chase small, speculative stocks, the best opportunities in AI might be with established tech giants. Companies like Microsoft (NASDAQ: MSFT) and IBM (NYSE: IBM) are already leading the charge in AI innovation and have a proven track record of rewarding investors with consistent dividends. For those seeking a balance of safety and upside potential, large-cap AI stocks like these are an excellent starting point. But that doesn’t mean you should ignore smaller players altogether—you just need to do your due diligence.

How to Avoid AI Stock Land Mines

When considering any AI company, especially smaller ones, it’s essential to remain cautious. Many will make bold claims about their potential but lack the substance to back them up. Here are a few tips on how to avoid AI stock land mines: Look for Dividend History—companies that have consistently paid and increased dividends are usually in a better financial position. Analyze Financials—pay close attention to a company’s revenue, earnings, and cash flow. If these are lacking, it’s a red flag. Check Leadership and Innovation—strong leadership and a commitment to innovation are key indicators of a company’s long-term viability in the AI space. By following these principles, you can increase your chances of finding AI stocks with real potential and avoid getting burned by hype.

Conclusion: Invest Wisely and Avoid AI Land Mines

Investing in AI can be incredibly rewarding, but it’s essential to approach it with caution. By focusing on dividend-paying AI stocks, doing thorough research, and avoiding overhyped companies, you can position yourself for long-term success in this exciting sector. So, as you explore AI investment opportunities, remember the lessons from 1996—avoid the land mines and focus on companies with real potential to grow and thrive.

Hey there! I’m Russ Amy, here at IU I dive into all things money, tech, and occasionally, music, or other interests and how they relate to investments. Way back in 2008, I started exploring the world of investing when the financial scene was pretty rocky. It was a tough time to start, but it taught me loads about how to be smart with money and investments.

I’m into stocks, options, and the exciting world of cryptocurrencies. Plus, I can’t get enough of the latest tech gadgets and trends. I believe that staying updated with technology is key for anyone interested in making wise investment choices today.

Technology is changing our world by the minute, from blockchain revolutionizing how money moves around to artificial intelligence reshaping jobs. I think it’s crucial to keep up with these changes, or risk being left behind.